Reposted from the Washington Post.

The pay gap between men and women narrowed last year, but not by much.

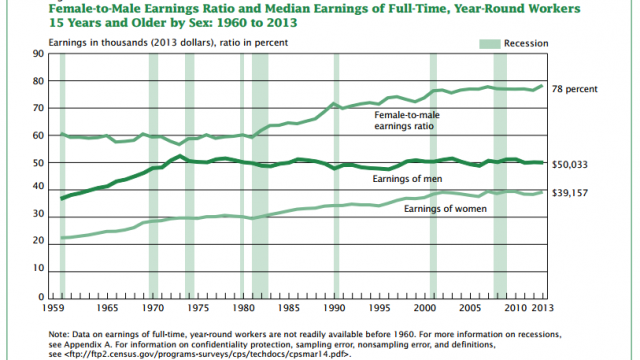

Women earned 78.2 cents for every dollar earned by men in 2013, up from 76.5 cents in 2012, according to income data released by the U.S. Census Bureau. That gap is essentially unchanged from before the recession and is slow progress from 1961, when women earned about 60 cents for every dollar.

The pay difference has an impact beyond the workplace. Financial advisers and analysts say the gap is one of the main reasons women are drastically behind men when it comes to retirement savings. As I previously reported, figures from the Employee Benefit Research Institute show that women have an average of $81,700 saved in their individual retirement accounts, compared to the average $139,467 saved by men. And that was despite the fact that women contributed just as often to their retirement accounts as men did. (And no, it’s not because they’re spending all of their money on shoes.)

“With women earning less, that equates to a lesser ability to save,” says Catherine Collinson, president of the Transamerica Center for Retirement Studies, a nonprofit that focuses on improving retirement security.

Indeed, a survey conducted earlier this year by the Transamerica Center for Retirement Studies found that women were more likely to say their top financial priorities were paying off debt and covering basic living expenses. More men said their top financial concern was paying for retirement.

That difference may help explain why women save less than men do: They contributed an average 10.8 percent of their pay to retirement accounts in 2014, compared to 11.4 percent for men. (Even socking away the same share wouldn’t do it. Women would have to put away a much larger share of their income to make up for the 22 percent gap in pay.)

At least part of the gap in retirement savings can be explained by differences in the type of jobs women land when compared to men, Collinson says. Because women are more likely to work part time, she says, they are also less likely to have access to a workplace retirement savings plan or a pension.

But even women who save as much as men may find other setbacks when it comes to retirement income. The lower pay they receive throughout their careers will also lead to smaller Social Security benefits in retirement, Collinson says.